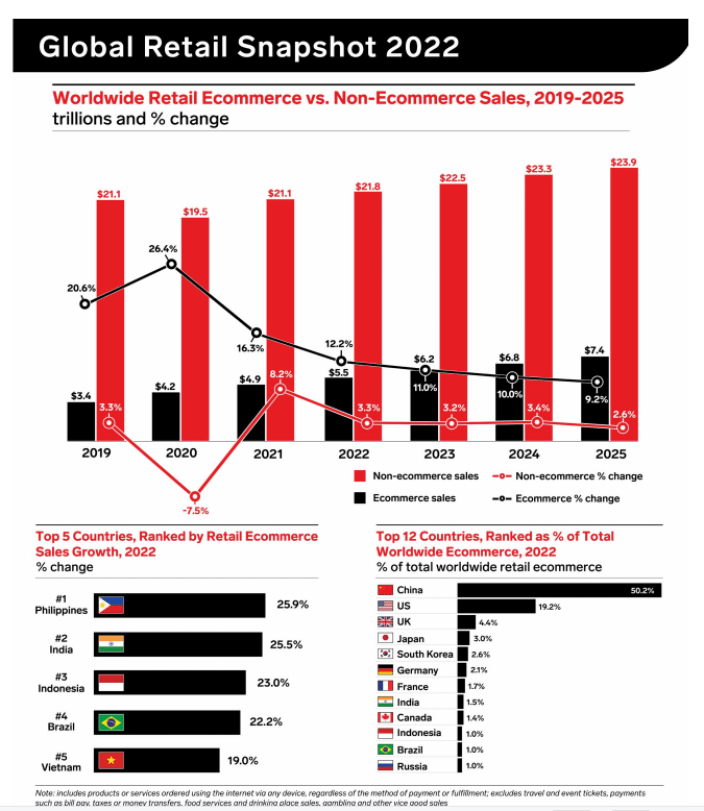

In 2022, global e-commerce sales are expected to exceed US$5 trillion for the first time, accounting for 1/5th of overall retail sales. And in 2025, this figure is expected to exceed US$7 trillion. The e-commerce market is expected to continue its growth trajectory through 2025.

eMarketer reports key points

•The growth of e-commerce sales will slow down significantly. Global e-commerce sales are expected to increase by 12.2% in 2022. While this is slightly lower than the figures for the last 2 years, the 12.2% increase still means that $603.68 billion more will be spent online in 2022 than in 2021. It is the largest increase on record;

• In 2021, the offline channel rebounded well ahead of expectations. It recovered and even surpassed pre-epidemic levels 2 years earlier than we initially forecast;

• Emerging economies will be rejuvenated by the rapid rise of e-commerce markets locally. At the beginning of the epidemic, e-commerce markets in both developed and developing countries saw significant growth;

• The number of online consumers grew at a slower rate, at around 2.56 billion. Newer online customers are mainly from India, Indonesia, Brazil, and some other emerging markets.

E-commerce market growth slows in 2022, but the overall consumer market remains dynamic

A decade ago, total global retail sales were also just over US$16 trillion, while global consumer spending on the online shop will increase by US$603.68 billion in 2022 compared to 2021. By 2025, this figure will be as high as US$7.391 trillion, and in 2022, e-commerce sales will represent a significant leap forward at over 20% of total global retail sales.

In 2021, the gap between online and offline sales growth shrinks to 8.1%, the lowest ever. The gap between the two will continue at 2021 levels in the coming years.

The return of offline shops is about to challenge online sales

In May 2021, eMarketer had forecast an annual increase in total global retail sales of 6.0%, slightly above US$25 trillion. But what was finally achieved was a higher-than-expected increase of 9.7%. Total global retail sales reached US$26.031 trillion. It can be concluded that the contribution of the offline economy to the rebound in the consumer market should not be underestimated.

Offline retail rebounded by 8.2% to $21.094 trillion in 2021, surpassing total global retail sales in 2019. It is expected to grow between 2.6% and 3.4% by 2025. Despite the slower growth rate of offline retail, additions in 2022 will still be higher than e-commerce sales.

Mobile e-commerce as a share of total e-commerce sales maintains growth but tends to slow

Two key factors dominate this trend:

• Internet users in North America and Europe have become accustomed to spending on mobile devices. But more often than not, they still shop via PC. The shift from the former to the latter continues, but at a slower pace than before;

• In emerging markets, where the internet and smartphones are becoming more and more popular, new users are decreasing.

Retail Mcommerce Sales Share Worldwide, by Region, 2022

• Regionally, the gains in Latin America and southeast Asia continue to be impressive. They will be the only two regions where e-commerce sales will increase by more than 20% in 2022. In these regions, the number of online shopping groups is still growing.

• Countries in the Asia-Pacific region will lead the growth in e-commerce sales. Countries such as the Philippines, India, and Indonesia are set to lead the rest of the world in 2022. Vietnam, Malaysia, and Thailand will also be in the top 10 global growth rankings for e-commerce growth.

•Countries such as Indonesia, the US, and Brazil are climbing up the rankings for e-commerce penetration. China, the UK, and South Korea will continue to lead the rest of the world.

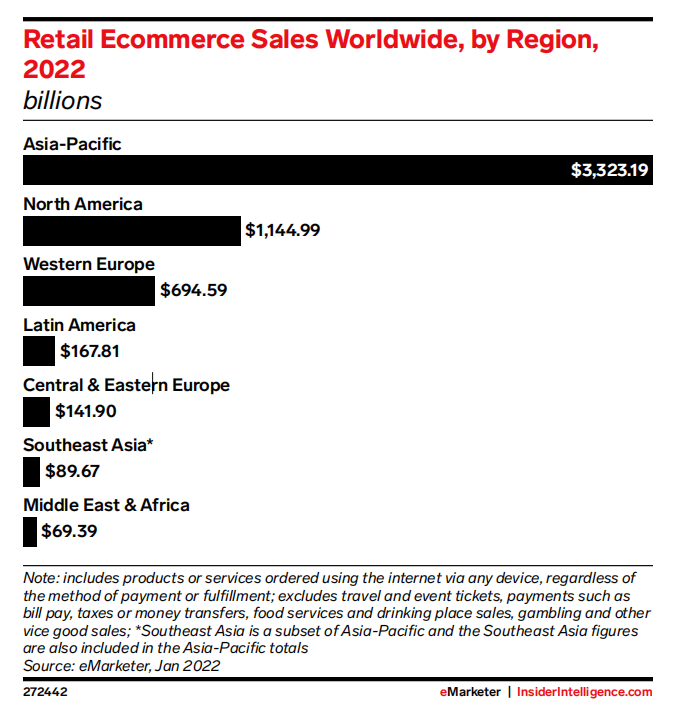

Overall slower growth of the Asia-Pacific region

The Asia Pacific region as a whole has seen global e-commerce growth of 11.8% this year, one of the slower growth rates in the world, and will see the slowest increase in the region’s history. The slowdown in China will have a greater impact on the overall growth of the Asia Pacific region.

• Latin America is set to rank second in global e-commerce sales growth. This year, the region’s growth is expected to fall by 15 percentage points, but it will still be well ahead of most other regions.

• North America: The US has been surprisingly resilient in its e-commerce growth rate. A smaller decline in economic growth is expected in the coming years.

• the Middle East and Africa: many country markets are still in their early stages and therefore their high growth phase will outlast the epidemic era in the future. •Western Europe: The region will see its lowest ever e-commerce growth rate of 6.1% this year. The majority of Western European countries have seen their e-commerce growth rates hit record highs in 2020. And 2021 is also a year of exceptionally high growth for the industry. It is expected that the region’s growth momentum will drop back significantly in 2022.

Emerging country markets to see faster e-commerce sales growth

In 2022, fast-growing emerging markets will return to the top 10 in terms of e-commerce sales growth, in turn overtaking more established national markets such as Canada, Singapore, the Netherlands, and Russia. Among the developed economies, only the US is expected to be in 10th place.

Other observations from the data

• India and the Philippines will be vying for the top spot in the coming years.

• No country market in Western Europe is expected to achieve growth above 10% in e-commerce sales by 2025.

• E-commerce sales are expected to grow in each of the country markets surveyed in Latin America up to 2025, at a rate of at least 10% per year.

• Future growth in the Asia Pacific will be concentrated in India and South East Asia. The growth rate of e-commerce sales in these regions will remain strong in the future.

Other notable trends

• India managed to jump into the top 10 in retail e-commerce sales in 2016 and has already risen to 8th place, with the country set to overtake France to reach 7th place next year and Germany to reach 6th place by 2025.

• Indonesia overtakes Brazil in the top 10. 2022 will see fierce competition between these two national markets for the 10th place in the future.

The popularity of e-commerce remains geographically diverse

By 2022, e-commerce is expected to account for more than 10% of total retail sales in some 20 major economies worldwide. While e-commerce sales are still growing in individual country markets, most of them will eventually account for less than 15% of total retail sales.

The e-commerce sector is more popular in North-East Asia, North America, and the Nordic region.

•In addition to the top 10, major national markets in Latin America are the fastest rising in the rankings.

• Five years ago, only 10.3% of global retail sales came from retail e-commerce. Although the growth rate of global e-commerce will decline from now on, the share of global retail e-commerce to total retail sales is expected to more than double by next year.

How will e-commerce operators acquire new buyers after 2022?

• Global online buyer growth is only 4.8% in 2021.

•The global online buyer base is expected to grow by 3.4% in 2022.

• Only 85.5 million new buyers are expected to emerge in 2022. This compares to 258.3 million people becoming online buyers in 2020.

Due to the epidemic, the number of online buyers will grow relatively slowly and marketers of e-commerce operators will have to work harder to widen the scope of their search audience.

By 2022, 2.56 billion online buyers will exist worldwide.

•Chinese online buyers will account for 32.9% of the total global population, or 843.3 million.

•India will have 312.7 million online buyers (an increase of more than 100 million compared to the pre-epidemic era)

• The United States will come in third at 214.1 million, up 4.5 million from last year

As the world matures in its digital transformation, the ranking of online buyers by country will more fully reflect the ranking of the total population. There will still be many more online buyers coming to market around the world for a long time to come.

Which region is where the number of online buyers is growing?

In terms of regions, the Middle East and Africa will be the only region in the world where the online buyer base will grow by more than 5%.

Latin America will come in second with 4.6%, but Latin America will have more new buyers than the Middle East and Africa.

Brazil will remain relatively even with Latin America with a growth rate of 5.0%. This is one of the few country markets worldwide to reach this threshold.

The Asia Pacific is home to 59.4% of the world’s online buyers. Although the growth in the number of online buyers in the region will reach an all-time low in 2022 (3.8%), there will still be 55.3 million new buyers this year.

Meanwhile, India will account for a greater proportion of these new buyers than any other region. However, Indonesia will achieve the fastest growth in the region and globally with 8.8% (the country has a total of 81.1 million buyers).

In developed economies, growth in the number of online buyers will be rather sluggish. in 2022, the buyer base is expected to increase by just 5 million in North America and 2.7 million in Western Europe. The numbers in Japan (up 0.5%) and South Korea (up 0.9%) will grow more slowly than in the Western countries.

Although the growth in the number of buyers in Latin America and the Asia Pacific has slowed significantly, there will still be tens of millions of new online buyers who will likely be more accessible to sellers than the sophisticated and dispersed online buyers in North America, Western Europe, and Northeast Asia.

The opportunities for global retail e-commerce are hidden in 2022 and beyond.

3 thoughts on “2022 E-Commerce Market Worldwide Forecast Report”